MSME Day 2022: Startups lighting up the way for MSME in India

International MSME Day 2022 is to be celebrated on Monday, June 27th. MSMEs are the spine of the Indian economy , and it has played a vital role in the country's economic development. MSMEs touch the lives of every citizen in India, whether it is a Kirana store that sells groceries or the next-door boutique making the favorite dress, mobile recharge stores, stationery shops, small factories on the city's outskirts supplying several components to different sectors, etc. Most of these micro-entrepreneurs or small retailers in the country remain informal and primarily deal with cash.

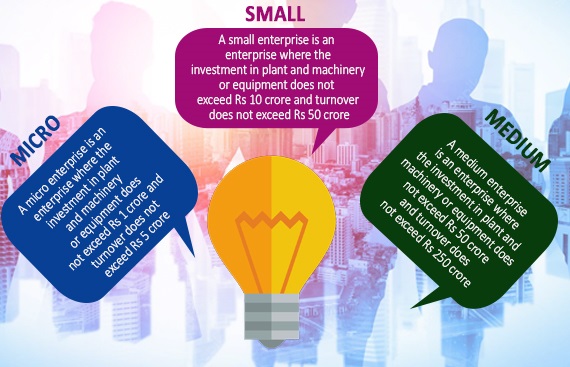

The standards for representing the size of a business vary from country to country. The definition of micro, small and medium-sized enterprises in India is determined according to Investment in Plant & Machinery/equipment and Annual Turnover.

MSMEs Contribution to Indian Economy

According to the data from Central Statistics, Ministry of Statistics & PI, the share of MSME Gross Value Added in All India Gross Domestic Product at existing prices for 2018-19 and 2019-20 were 30.5% and 30.0%, respectively.

The share of the MSME in manufacturing gross value output during the year 2018-19 and 2019-20 were 36.9% and 36.9%, respectively.

The share of selected MSME-related products to All India exports during 2019-20 and 2020-21 was 49.8% and 49.5%, respectively.

As per the NSS Report on Unincorporated Non-Agricultural Enterprises' (July 2015- June 2016) shown by the Ministry of Statistics & PI, the estimated number of workers in the MSME sector was 11.10 crore.

Under the PMEGP, the evaluated employment generated in micro-enterprises during the year 2020-21 and 2021-22 (as of 01.07.2021) is 5.95 lakh and 1.19 lakh, respectively.

How are Startups aiding MSMEs?

The MSME sector has been in a hassle with issues such as insufficient finances, regulatory stoppages, infrastructural deficiency, and outdated technology. It has prevailed against demonetization and GST implementation and is now gearing up to tide over the Covid-19 crisis. The pandemic is a watershed situation for the MSME sector. It has made it crucial for the MSME businesses to digitally re-orient their workplaces, re-imagine their business practices and determine the right course for growth, especially during the lockdowns.

Digital Adoption

The transition towards adopting digital technology solutions among micro, small and medium enterprises has been evident with startups digitizing almost every part of the business, such as lending, bookkeeping, procurement of goods, selling goods and services, sales, and marketing, recruitment, and more across multiple sectors. The opportunity, hence, in digitizing small businesses is expanding — around $85 billion by 2024 from around $30 billion in 2019, according to the report. The growth is also because startups are increasingly evolving into a one-stop-shop or end-to-end technology solutions providers instead of specializing in one aspect.

An IT services firm specialized in web hosting revealed that 30 percent of MSMEs have started a business website or engaged in e-commerce since the lockdown. More than 50% of MSMEs adopted video conferencing tools and WhatsApp to assure business continuity. Another fantastic example is a remarkable partnership between Mother Dairy and IBM, which enabled 500 employees of Mother Dairy to work from home by using a virtual computing environment and Mother Dairy’s data center.

The role of startups in taking the MSMEs to greater heights cannot be ignored. Startups, beaming with technologies, have the potential to disrupt markets, and collaboration between startups and MSMEs can be seen as a game-changer. For MSMEs, innovation needs must go in every stage – procuring raw materials and workforce and undertaking manufacturing and digital marketing. The business model can use advanced tools such as artificial intelligence, machine learning, and blockchain technology. To the extent feasible, MSMEs should drive off-line activities to an omnichannel platform.

Finance

Difficulties in getting loans for businesses and their daily financial business operations are affected in two ways when there is a hike in interest rates. Firstly, long-term debt becomes more costly, especially if the loan has a varying interest rate. As the loan becomes more expensive, it will take longer to pay off. This results in improved financing costs and a lower income. Short-term loans become more expensive as well with high-interest rates. This means it is more challenging for small businesses to meet their financial burdens, especially if there is an increase in unexpected expenditures. If companies do not have sufficient cash flow, they may have trouble carrying out their operations.

Startups are picking other ways to bridge the human-digital gap. They are offering a range of digital assets to support the loan products. Emerging digital lending services can solve these challenges. MSMEs can borrow through digital lending platforms, which quickly access app-based interfaces. Alternate data points like cash flows, GSTN, payroll, and utility payments are used to assess MSMEs' credit risk without a credit history.

Conclusion

However startups have partnered with millions of MSMEs spread across the country to provide banking, payments services and digital solutions. As the private sector innovates and the government guides innovation, the focus must be more on the growth of startups. In this process, MSMEs get more benefits from startups.

The standards for representing the size of a business vary from country to country. The definition of micro, small and medium-sized enterprises in India is determined according to Investment in Plant & Machinery/equipment and Annual Turnover.

MSMEs Contribution to Indian Economy

According to the data from Central Statistics, Ministry of Statistics & PI, the share of MSME Gross Value Added in All India Gross Domestic Product at existing prices for 2018-19 and 2019-20 were 30.5% and 30.0%, respectively.

The share of the MSME in manufacturing gross value output during the year 2018-19 and 2019-20 were 36.9% and 36.9%, respectively.

The share of selected MSME-related products to All India exports during 2019-20 and 2020-21 was 49.8% and 49.5%, respectively.

As per the NSS Report on Unincorporated Non-Agricultural Enterprises' (July 2015- June 2016) shown by the Ministry of Statistics & PI, the estimated number of workers in the MSME sector was 11.10 crore.

Under the PMEGP, the evaluated employment generated in micro-enterprises during the year 2020-21 and 2021-22 (as of 01.07.2021) is 5.95 lakh and 1.19 lakh, respectively.

How are Startups aiding MSMEs?

The MSME sector has been in a hassle with issues such as insufficient finances, regulatory stoppages, infrastructural deficiency, and outdated technology. It has prevailed against demonetization and GST implementation and is now gearing up to tide over the Covid-19 crisis. The pandemic is a watershed situation for the MSME sector. It has made it crucial for the MSME businesses to digitally re-orient their workplaces, re-imagine their business practices and determine the right course for growth, especially during the lockdowns.

Digital Adoption

The transition towards adopting digital technology solutions among micro, small and medium enterprises has been evident with startups digitizing almost every part of the business, such as lending, bookkeeping, procurement of goods, selling goods and services, sales, and marketing, recruitment, and more across multiple sectors. The opportunity, hence, in digitizing small businesses is expanding — around $85 billion by 2024 from around $30 billion in 2019, according to the report. The growth is also because startups are increasingly evolving into a one-stop-shop or end-to-end technology solutions providers instead of specializing in one aspect.

An IT services firm specialized in web hosting revealed that 30 percent of MSMEs have started a business website or engaged in e-commerce since the lockdown. More than 50% of MSMEs adopted video conferencing tools and WhatsApp to assure business continuity. Another fantastic example is a remarkable partnership between Mother Dairy and IBM, which enabled 500 employees of Mother Dairy to work from home by using a virtual computing environment and Mother Dairy’s data center.

The role of startups in taking the MSMEs to greater heights cannot be ignored. Startups, beaming with technologies, have the potential to disrupt markets, and collaboration between startups and MSMEs can be seen as a game-changer. For MSMEs, innovation needs must go in every stage – procuring raw materials and workforce and undertaking manufacturing and digital marketing. The business model can use advanced tools such as artificial intelligence, machine learning, and blockchain technology. To the extent feasible, MSMEs should drive off-line activities to an omnichannel platform.

Finance

Difficulties in getting loans for businesses and their daily financial business operations are affected in two ways when there is a hike in interest rates. Firstly, long-term debt becomes more costly, especially if the loan has a varying interest rate. As the loan becomes more expensive, it will take longer to pay off. This results in improved financing costs and a lower income. Short-term loans become more expensive as well with high-interest rates. This means it is more challenging for small businesses to meet their financial burdens, especially if there is an increase in unexpected expenditures. If companies do not have sufficient cash flow, they may have trouble carrying out their operations.

Startups are picking other ways to bridge the human-digital gap. They are offering a range of digital assets to support the loan products. Emerging digital lending services can solve these challenges. MSMEs can borrow through digital lending platforms, which quickly access app-based interfaces. Alternate data points like cash flows, GSTN, payroll, and utility payments are used to assess MSMEs' credit risk without a credit history.

Conclusion

However startups have partnered with millions of MSMEs spread across the country to provide banking, payments services and digital solutions. As the private sector innovates and the government guides innovation, the focus must be more on the growth of startups. In this process, MSMEs get more benefits from startups.