The New Age CFO - Driving Value Through Analytics

A dynamic professional with 20 years of experience in the areas of Finance Transformation, Data Analytics, Digitization, Accounting and Finance, Shared Services Management, ERP implementation and Audits

We have been hearing a lot 'Data is the new gold' or 'Data is the new oil' and that the CFO plays an important role to make the data talk that will help in decision making for the management. This article tries to highlight some important aspect of How a CFO should handle the Data Analytics function basis some practical experiences of the author.

Let us try to understand an ideal cycle of preparing any Analytics basis my practical experience in the finance function:

•It all starts with an idea or Problem – It is very important to fall in love with the problem and brainstorm to understand if this problem is tracked/ represented properly.

•Investigate the problem with cross functions and understand what information is needed to take actions and what impact it would have if acted upon.

•Start exploring the Draft Analytics – Mobilize resources, systems involved and data availability from various systems to make a rough sketch of Data modelling.

•Prepare the Draft analytics and question your self is it making sense from business perspective? An affirmative answer should drive the next step to socialize with key stakeholders.

•The next step would be to engage with relevant stakeholders and get into trial and error of improving Data visualization. Some key things to check here would be emotions of stakeholders on data, their active engagement while you are presenting and gather feedback.

•Once all validations and inputs/feedback are done, present to your sponsors the final data visualization and establish credibility as to what actions the analytics would drive and who will take those actions basis the data.

•Take feedback from sponsors, simplify if needed to enhance and improvise the analytics.

•Final socialization with sponsors and ensure topdown messaging from sponsors to establish credibility of analytics with recipients.

•Ensure the usage of analytics and actions are taken appropriately based on insights.

•The last step would be to handover the analytics to Business sponsor team to maintain on regular basis.

Some Key Aspects While Doing any Analytics

Pathos is very Important: While as finance function, we are very strong on logic with numbers and have good credibility on financials but what we lack is the emotional connect with stakeholders and this is very important while working on any Data Analytics.

Establish Emotional connect through Story Telling: Story telling is an art to explain the numbers starting with a problem and then explaining the peak of problem and how the data can help to have happy ending. It can be corelated with real life example or a theme to emotionally connect with audience fore.g. A firm who is bleeding on bad margins due to bad pricing for few products can explain to COO’s their numbers with a story like "What is our Everest on Pricing of XYZ Product and then go on to co relate on how one would summit the margins with steps to summit the Everest”.

Fail Fast & Fail Cheap

As finance guys, we tend to get into 'Analysis- Paralysis', Reconciliations and may at times complicate the analytics. It is very important to take feedback, respect experience of stakeholders and fail fast to improvise the analytics. At times, one may stop doing the analytics further if it doesn’t add value to the organization but only a piece of fancy report.

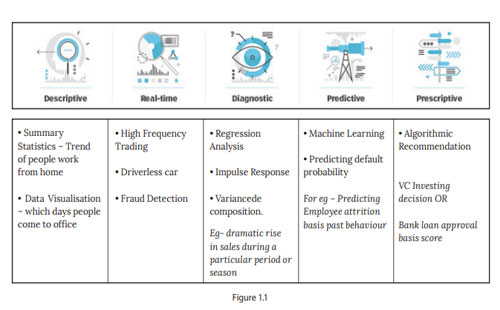

Ensure you use the Right Analytics as per Problem

There are various forms of analytics, and one needs to determine the right one to use to substantiate the problem. (fig. 1.1)

Reinforce Analytics

From time to time, it is very important that you feed the analytics with additional information to improve the sense of data and hence insights. This is called reinforcing analytics with new data.For e.g. We are working on predicting attrition and a new data emerges from HR about people working in shift then the attrition prediction should be reinforced with change in probability for people working in shift/over time.

One Story - Multiple Interpretation

One analytics may mean different things to different stakeholders. Hence it is very important to tell the right story as per the stakeholder being addressed. For e.g. Once we did analytics on Quality of hires and how we had hired people with higher experience in lower grade with a beautiful visualization.

For CFO – The story was Are we selling this high experience hired at lower grades at right price.

FOR CHRO – The story was Should we promote these employees to avoid attrition later.

For COO – The story was Are we positioning such experienced resources at right roles with our client though they are in lower grade.

Developing Talent is the key

Inhouse talent in finance who know systems, processes and have reasonable understanding of business are the ideal candidates to start with a Data miner role in Analytics. Someone who has played a role of Controlling, Management reporting or Pricing and worked closely with business can play a role of Story teller. Data miner can slowly grow either into Data scientist doing Data modelling or a storyteller based on his interest and capabilities.

Finally, Culture that a CFO Need to Develop a Strong Analytics Team to Serve Business

•Right team is the key – Segregate conceptualization and Delivery

•Right mind set is more important than skill set – Understanding business is key.

•Collaboration beyond finance is the key to success.

•Encourage Brainstorming to fall in love with the problem

•Respect experience and take feedback Don’t be afraid to engage with stake holders.

•Fail fast and fail cheap Adopt and change, Check emotions/reactions of people.

•Avoid Analysis paralysis directional view is the key

•Who will take action and use it Improvise till you have this answer?

•Learn from failures to emerge even better.

•Exit mode is important –don’t get into maintenance but conceptualize and hand over.

We have been hearing a lot 'Data is the new gold' or 'Data is the new oil' and that the CFO plays an important role to make the data talk that will help in decision making for the management. This article tries to highlight some important aspect of How a CFO should handle the Data Analytics function basis some practical experiences of the author.

Let us try to understand an ideal cycle of preparing any Analytics basis my practical experience in the finance function:

•It all starts with an idea or Problem – It is very important to fall in love with the problem and brainstorm to understand if this problem is tracked/ represented properly.

•Investigate the problem with cross functions and understand what information is needed to take actions and what impact it would have if acted upon.

•Start exploring the Draft Analytics – Mobilize resources, systems involved and data availability from various systems to make a rough sketch of Data modelling.

•Prepare the Draft analytics and question your self is it making sense from business perspective? An affirmative answer should drive the next step to socialize with key stakeholders.

•The next step would be to engage with relevant stakeholders and get into trial and error of improving Data visualization. Some key things to check here would be emotions of stakeholders on data, their active engagement while you are presenting and gather feedback.

•Once all validations and inputs/feedback are done, present to your sponsors the final data visualization and establish credibility as to what actions the analytics would drive and who will take those actions basis the data.

•Take feedback from sponsors, simplify if needed to enhance and improvise the analytics.

•Final socialization with sponsors and ensure topdown messaging from sponsors to establish credibility of analytics with recipients.

•Ensure the usage of analytics and actions are taken appropriately based on insights.

•The last step would be to handover the analytics to Business sponsor team to maintain on regular basis.

Some Key Aspects While Doing any Analytics

Pathos is very Important: While as finance function, we are very strong on logic with numbers and have good credibility on financials but what we lack is the emotional connect with stakeholders and this is very important while working on any Data Analytics.

Establish Emotional connect through Story Telling: Story telling is an art to explain the numbers starting with a problem and then explaining the peak of problem and how the data can help to have happy ending. It can be corelated with real life example or a theme to emotionally connect with audience fore.g. A firm who is bleeding on bad margins due to bad pricing for few products can explain to COO’s their numbers with a story like "What is our Everest on Pricing of XYZ Product and then go on to co relate on how one would summit the margins with steps to summit the Everest”.

Story telling is an art to explain the numbers starting with a problem and then explaining the peak of problem and how the data can help to have happy ending

Fail Fast & Fail Cheap

As finance guys, we tend to get into 'Analysis- Paralysis', Reconciliations and may at times complicate the analytics. It is very important to take feedback, respect experience of stakeholders and fail fast to improvise the analytics. At times, one may stop doing the analytics further if it doesn’t add value to the organization but only a piece of fancy report.

Ensure you use the Right Analytics as per Problem

There are various forms of analytics, and one needs to determine the right one to use to substantiate the problem. (fig. 1.1)

Reinforce Analytics

From time to time, it is very important that you feed the analytics with additional information to improve the sense of data and hence insights. This is called reinforcing analytics with new data.For e.g. We are working on predicting attrition and a new data emerges from HR about people working in shift then the attrition prediction should be reinforced with change in probability for people working in shift/over time.

One Story - Multiple Interpretation

One analytics may mean different things to different stakeholders. Hence it is very important to tell the right story as per the stakeholder being addressed. For e.g. Once we did analytics on Quality of hires and how we had hired people with higher experience in lower grade with a beautiful visualization.

For CFO – The story was Are we selling this high experience hired at lower grades at right price.

FOR CHRO – The story was Should we promote these employees to avoid attrition later.

For COO – The story was Are we positioning such experienced resources at right roles with our client though they are in lower grade.

Developing Talent is the key

Inhouse talent in finance who know systems, processes and have reasonable understanding of business are the ideal candidates to start with a Data miner role in Analytics. Someone who has played a role of Controlling, Management reporting or Pricing and worked closely with business can play a role of Story teller. Data miner can slowly grow either into Data scientist doing Data modelling or a storyteller based on his interest and capabilities.

Finally, Culture that a CFO Need to Develop a Strong Analytics Team to Serve Business

•Right team is the key – Segregate conceptualization and Delivery

•Right mind set is more important than skill set – Understanding business is key.

•Collaboration beyond finance is the key to success.

•Encourage Brainstorming to fall in love with the problem

•Respect experience and take feedback Don’t be afraid to engage with stake holders.

•Fail fast and fail cheap Adopt and change, Check emotions/reactions of people.

•Avoid Analysis paralysis directional view is the key

•Who will take action and use it Improvise till you have this answer?

•Learn from failures to emerge even better.

•Exit mode is important –don’t get into maintenance but conceptualize and hand over.